SELL A BUSINESS

Let the professionals coordinate your business sale

We are a national brokerage with local brokers across Australia servicing all states, major cities and regional areas.

Our brokers have the knowledge, skills, and experience to help maximise your business’s value.

Start with a free consultation and meet your local broker. Then complete a free market appraisal to understand your business’s value in the current market and learn what preparation and marketing package is required to achieve a sale.

This process will help you and your broker set a budget and determine when to go on the market. If we’ve done our job right, you decide if we are right for you. There is no cost, no commitment until you’re ready.

Our Process

Step 01

Obligation Free Appraisal

Step 02

Document Preparation

Step 03

High Visibility Marketing

Step 04

Selling Your Business

Step 05

Closing The Sale

Step 01

Obligation Free Appraisal

With the Finn Business Sales obligation-free appraisal, we assess the value of your business and help you set your price range for sale. The market will determine the final selling price, influenced by banks, accountants, advisors, and the economy.

Step 02

Document Preparation

We help you prepare your business for sale by guiding you through the most appropriate documents required to present your business for sale accurately. Preparing your business and being transparent and informative will lead to a greater sale result.

Basic

Typically for

Micro Businesses

Business Summary

A Business Summary is a document that answers all the basic questions about your business.

+ Due Diligence

Profit & loss, lease details, licenses, payroll information, and plant equipment.

Standard

Typically for

Small Business

Business Profile

The Business Profile provides a full description of your business and assists in marketing the business to interested buyers. The document is a valuable resource for dealing with accountants, advisors and banks.

+ Due Diligence

We investigate areas such as the customers, business operations, financial performance, BAS statements, payroll, contracts, intellectual property, assets and other relevant details.

Professional

Typically for

Small – Medium Business

Information Memorandum

An Information Memorandum provides a comprehensive description of all aspects of the business and market. It is intended to provide all the information required by an investor to make a fully informed decision. It is a necessary resource for buyers when dealing with their accountant, financial advisors and bank.

+ Due Diligence

Conducting a due diligence process is critical to evaluate both the risks and opportunities of the acquisition. We provide access to detailed information such as the business operations, financial performance, BAS statements, payroll, customer and supplier contracts, customer and sales reports, intellectual property, assets, and other relevant details.

Step 03

High Visibility Marketing

Gain reach and increase your number of buyer enquiries – eight proven methods and easy weekly contributions equal market-leading value. Our comprehensive marketing packages have been designed to enable you to select a package suitable for your business needs and budget. The greater the exposure, the more leads generated to increase your chances of a sale.

With three marketing packages to choose from,Basic, Standard, and Professional, we will customise a marketing plan for your business, comprised of the following:

Be seen on leading Business For Sale sites:

Increase your reach across digital marketing platforms with paid campaigns:

60000+

Database

We have thousands of potential buyers contact us each month and 60,000+ engaged buyers on our books.

Direct Email

Campaigns

We send direct email campaigns to all potential buyers on our database and conduct ongoing telephone follow ups.

Increased

Reach

We regularly post your listing on our Social channels Facebook and LinkedIn. Depending on your marketing package we will run targeted ads via Facebook, Instagram and LinkedIn.

Direct Mail

Campaign

Depending on your marketing package, we may target potential purchasers that own similar businesses via snail mail.

For Sale

Signage

On site For Sale signage is also available should we wish to encourage passing traffic and locals to enquire.

Local Area

Advertising

Where appropriate, we will establish a proposed local advertising schedule such as newspaper, print media and community display boards.

Step 04

Selling Your Business

There is an art to selling; you will see more success when a strong process is behind it. Our selling system is well-organised. You can be comfortable knowing that no stone is left unturned when we deal with your potential buyers, and we manage all the steps along the way.

Industry averages for brokers show that 60% of listed businesses sell between six and twelve months, 20% sell after twelve months, and 20% sell before the six months. With Finn, we tend to run a little quicker, and on average, we sell between three and nine months.

The process for a successful sale is as follows:

STEP 4.1

Buyer Screening

STEP 4.2

Business Review

Collate qualified buyers, educate them on buying a business and provide the business sale document

STEP 4.3

Fact Finding

Meeting 1: This is where we identify good prospects, by guiding buyers through questions, confirming their interest and capacity to purchase.

STEP 4.4

Narrow Down

Meeting 2: Due Diligence. Here we have determined the buyers suitability to purchase your business and have provided due diligence. The buyer is now focused and is considering their conditions of sale.

STEP 4.5

Discovery Tour

Meeting 3: 99% of people require meeting the owner and conducting a discovery tour. It is recommended the vendor and buyer meet under the guidance of the broker.

STEP 4.6

Offer Made

Meeting 4: Expression of interest, which means getting pen to paper and making an offer. From here, negotiations begin to close the sale and complete formalities.

Step 05

Closing The Sale

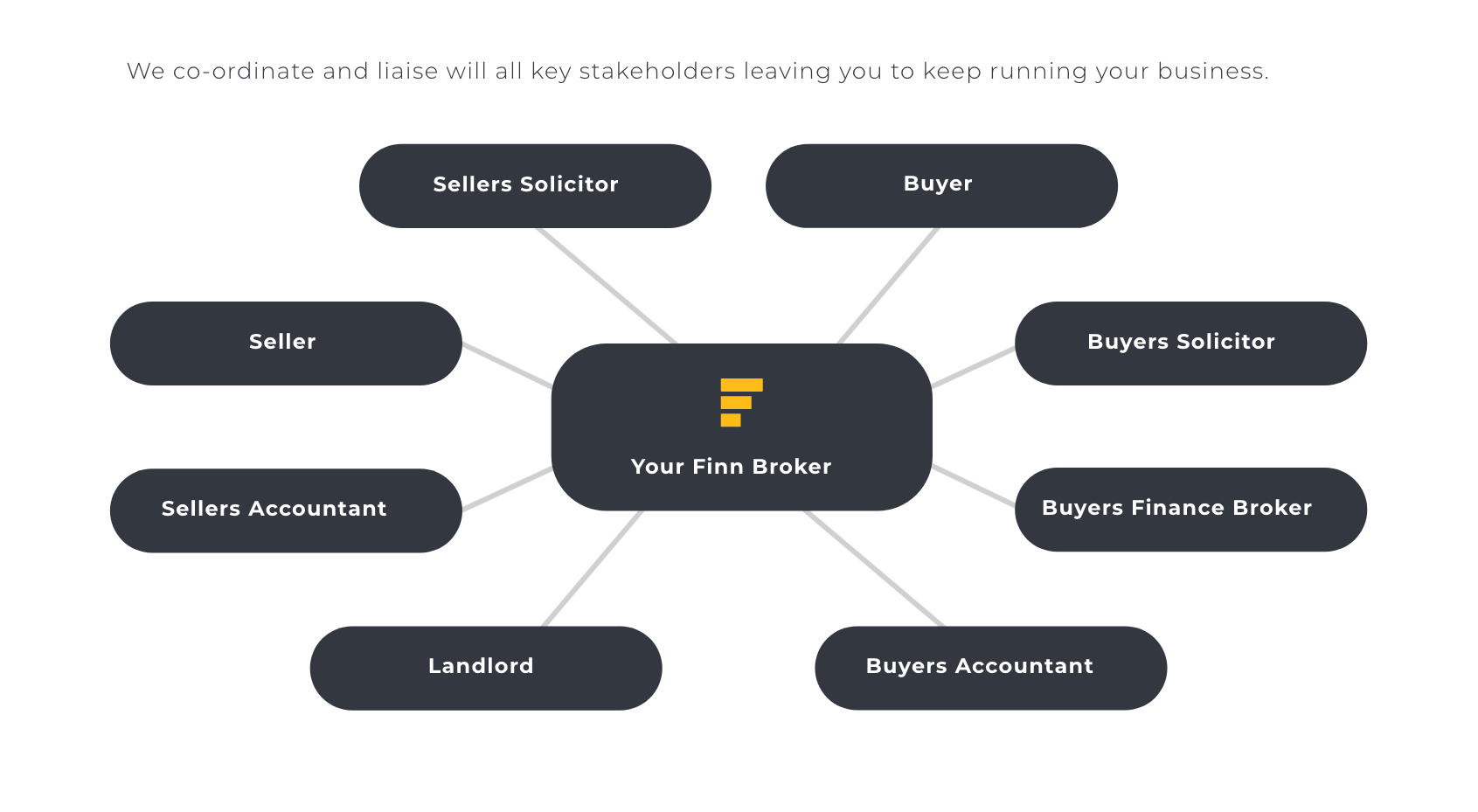

Closing the sale is intricate and where most of the work happens, as many advisors are involved.

You have a choice when it comes time to sell your business; you can save money and avoid paying commission by managing the sale yourself, or you can let our expert team do the selling and manage settlement on your behalf – this is where we see the most success. We will coordinate the entire process and deliver results, leaving you to keep running your business.

The process for a successful settlement is as follows:

STEP 5.1

Contract Prepared and Signed

· Briefing solicitors on key Contract Terms and special Conditions.

· Liaising with both parties and their solicitors to keep things on track.

· Ensuring Execution is complete and circulate copies as needed.

STEP 5.2

Due Diligence Managed

· Ensuring all due diligence is final and completed. (Normally done before Contract for small sales).

· Attend to any conditions precedent.

STEP 5.3

Finance Approval

· Referral to Finance Broker where needed

· Assist the Buyer with information for seeking finance approval.

· Chasing confirmation of Finance.

STEP 5.4

Landlord Approval

· Assist Buyer with Approval of Landlord of new Tenant. (Statement of Assets and Liabilities, Resume/CV, References, Application Form).

· Once approved, the Transfer Lease is normally prepared by the Buyer’s solicitor.

STEP 5.5

Staff Handover Arranged

· Identify Staff that will be offered transfers with the business.

(A detailed handover is beneficial to staff and the business overall, there will be less disruption to workflow and productivity).

STEP 5.6

Training Organized

· Liaising and coordinating training /assistance on negotiated terms as per the contract of sale.

STEP 5.7

Plant and Equipment Check

· A walkthrough of the Plant and Equipment listed in Contract of Sale to ensure that it is all there and Buyer knows where it is. (All equipment as listed must be handed over at settlement in good working order).

STEP 5.8

Settlement Organized

STEP 5.9

Handover Organized

· Transfer of ownership occurs at settlement, where payment and keys are handed over.

· Stocktake and payment for any stock are sorted either as part of Settlement or between Buyer and Seller.

Your Finn Broker will co-ordiante and liaise with all key stakeholders involved in your sale.

Ready to chat to your local broker?

Start the conversation

FINN INSIGHTS

How Long Does It Take To Sell A Business?

Contact Us

Please fill out the form below and we will be in touch with you as soon possible.